In this article:

Dying Without a Will and Succession

The Probate Process

The Value of Estate Planning

Introduction

Navigating the complexities of estate planning and probate laws can often feel overwhelming, especially when faced with terms like "testate" and "intestate." The purpose of this article is to break down these legal concepts and provide clear and understandable explanations for them. Our aim is to help you comprehend the implications of dying with or without a will in California and highlight the importance of sound estate planning.

Dying Without a Will and Succession

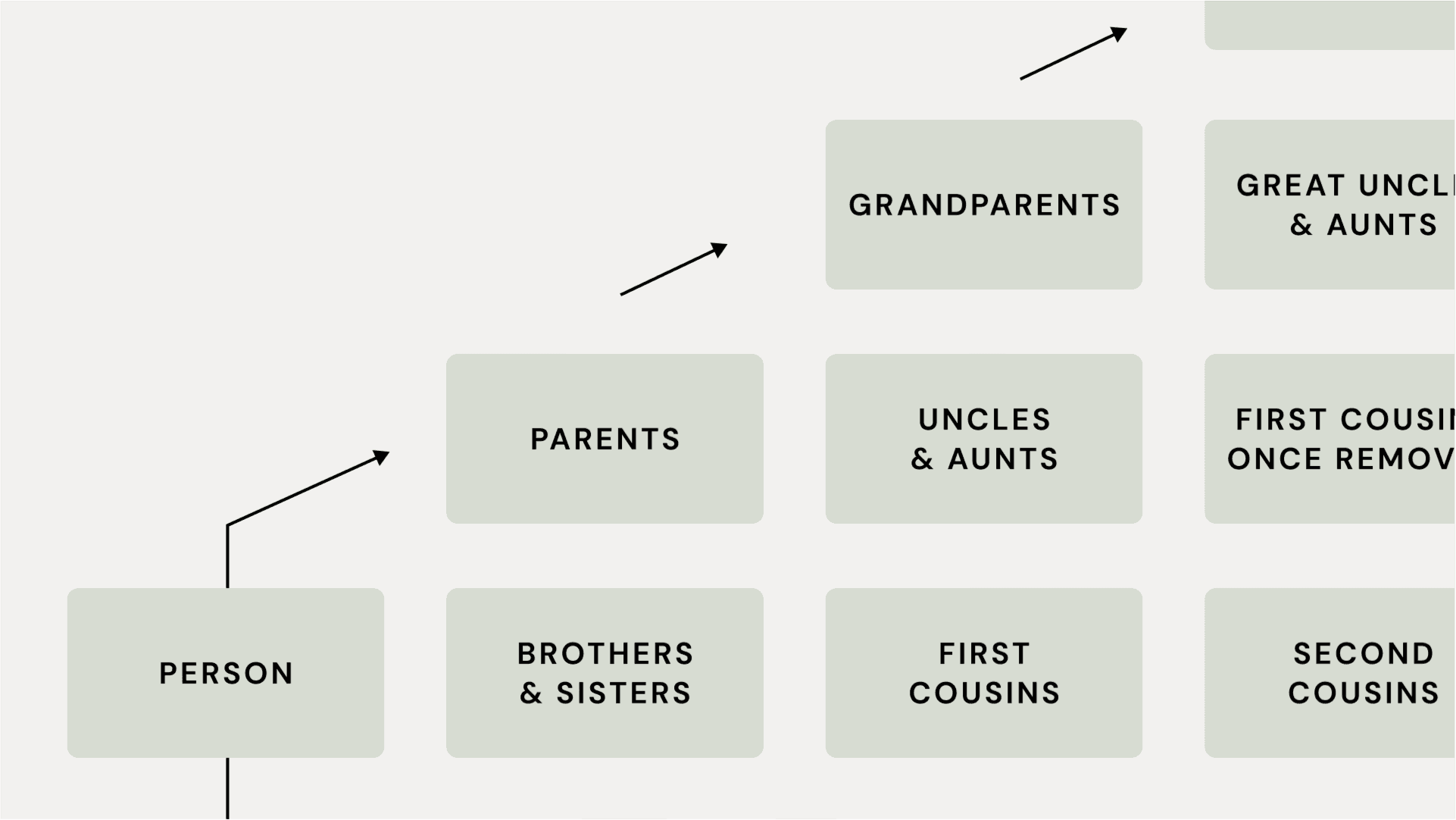

When a person dies without a will, they are said to have died "intestate". Dying intestate can lead to various complications, especially for the loved ones left behind. In such instances, California's laws of succession control what happens next.

To illustrate, let's consider the case of "John." John, a resident of California, passed away unexpectedly, leaving behind a wife and two adult children. Unfortunately, John never got around to preparing a will. As a result, the distribution of his estate will now be governed by California's intestacy laws.

Under these laws, his wife would inherit all of their community property (assets acquired during their marriage) and one-third to one-half of John's separate property (property acquired before marriage or received as a gift or inheritance during the marriage). The remaining separate property would be divided equally among his children.

If John had a will (i.e., he died "testate"), he could have specifically dictated how he wanted his assets to be distributed, possibly reducing potential disputes among his heirs or causing issues of divided ownership between his wife and children.

The Probate Process

Whether a person dies testate or intestate, their estate often goes through a legal process known as probate. Probate involves verifying the will (if there is one), appointing an executor or administrator, identifying and valuing the deceased person's assets, paying off their debts and taxes, and distributing the remaining assets to the rightful heirs or beneficiaries.

In our case study, since John died intestate, the court will appoint an administrator—often a surviving spouse or adult child—to oversee the probate process. This person will have the responsibility of paying off John's debts, valuing the assets, and ensuring that the remaining property is distributed according to California's laws of succession.

The probate process can be time-consuming, expensive, and stressful. It also becomes a matter of public record, which means that personal family matters can become available to the public.

The Value of Estate Planning

Estate planning goes beyond merely drafting a will. It involves developing a strategic plan to ensure that your assets are protected and distributed according to your wishes upon your death and incapacity. A robust estate plan can also provide mechanisms for managing your financial and medical decisions should you become unable to do so.

Let's imagine if John had an estate plan. He could have set up a living trust, which would allow his estate to avoid probate. A living trust is a legal arrangement that allows a person to hold title to an individual's assets as Trustee. Upon the individual's death, the assets are transferred directly to the trust beneficiaries without the need for probate.

Moreover, with an estate plan, John could have included a power of attorney and an advance healthcare directive. The power of attorney would allow a designated person (the attorney-in-fact) to manage his financial affairs if he became incapacitated. The advance healthcare directive would outline his wishes for medical care if he could not communicate them himself.

conclusion

The scenarios of dying testate versus intestate in California have significant legal and financial implications. Dying without a will means the distribution of one's assets may not align with one's personal wishes. On the other hand, having a well-crafted estate plan not only provides control over the distribution of assets but can also protect against unforeseen circumstances. In essence, estate planning is not merely a process for the wealthy; it's a critical step that every adult should take. It ensures that your wishes are honored and your loved ones are protected. At Harbor Probate Law, we understand the importance and complexities of estate planning. Our experienced and compassionate team in California is ready to guide you through every step of the process. Contact us today to discover how we can support you in securing peace of mind for you and your loved ones.